Class 10 Selina Maths – Chapter 1 GST Exercise 1(A) Full Solutions 💯 | Bastronautway | By Grandmaster Bikram Sutradhar 🏆 Best Teacher Award 2023 Winner

Class 10 Selina Maths – Chapter 1 GST Exercise 1(A) Full Solutions 💯 | Bastronautway | By Grandmaster Bikram Sutradhar 🏆 Best Teacher Award 2023 Winner

✅

Grandmaster Bikram sutradhar Athlete Chapter 12 – Organic Chemistry ICSE bikram Sutradhar Exercise 12C – ICSE Class 10 Chemistry Organic Chemistry Solutions | Selina Answers by Bastronautway

✅

ICSE Class 10 Selina Mathematics Chapter 1: GST Exercise 1(A)

with 100% accurate, step-by-step answers by Bastronautway. Expertly solved by Grandmaster Bikram Sutradhar — 🏆 Best Teacher Award 2023 Winner & 5 Times World Record Holder. Perfect for exam prep!

✨ EXERCISE 1(A)

1. Multiple Choice Type 📝

(a) 🧾 The marked price of an article is ₹1,500 and discount on it is 20%.

Explanation:

20% of ₹1,500 = ₹300 ➡️ Discounted price = ₹1,500 – ₹300 = ₹1,200

18% GST on ₹1,200 = ₹216 ➡️ Final price = ₹1,200 + ₹216 = ₹1,416

✅ Correct option: (ii) ₹1,416

(b) 🛍️

📦 Articles | 💰 Marked Price | 💸 GST Rate

A | ₹1,000 | 5%

B | ₹2,000 | 12%

Explanation:

GST on A = ₹1,000 × 5% = ₹50

GST on B = ₹2,000 × 12% = ₹240

Total cost = ₹1,000 + ₹50 + ₹2,000 + ₹240 = ₹3,290

✅ Correct option: (iii) ₹3,290

(c) 🚛:

Explanation:

This is an inter-state transaction. In such cases, only IGST is applied, and both SGST and CGST are not charged.

✅ Correct option: (iii) 0%

(d) 🌐

Explanation:

Inter-state GST is collected as IGST only, not divided into CGST or SGST. So, IGST is equal to the full rate.

✅ Correct option: (iv) IGST = 18%

(e) 🧾 The marked price of an article is ₹2,000.

Explanation:

Selling price after ₹500 discount = ₹1,500

12% GST on ₹1,500 = ₹180

Total payable = ₹1,500 + ₹180 = ₹1,680

✅ Correct option: (ii) ₹1,680

2. 🧮 Transaction within Delhi (Intra-State)

- MRP = ₹12,000

- Discount% = 30%

- GST% = 18%

✅ Discount = ₹3,600 (30% of ₹12,000)

✅ Discounted value = ₹8,400 (₹12,000 – ₹3,600)

✅ CGST = ₹756 (9% of ₹8,400)

✅ SGST = ₹756 (9% of ₹8,400)

✅ IGST = ₹0 (only for inter-state)

✅ Amount of bill = ₹8,400 + ₹756 + ₹756 = ₹9,912 ✅

3. 🚚 Transaction from Delhi to Jaipur (Inter-State)

- MRP = ₹50,000

- Discount = 20%

- GST = 28%

✅ Discount value = ₹10,000 (20% of ₹50,000)

✅ Discounted value = ₹40,000 (₹50,000 – ₹10,000)

✅ CGST = ₹0 (not applicable in inter-state)

✅ SGST = ₹0 (not applicable in inter-state)

✅ IGST = ₹11,200 (28% of ₹40,000)

✅ Amount of bill = ₹40,000 + ₹11,200 = ₹51,200 ✅

4. 🧑🔧 Mechanic in Delhi – GST on Repair Charges

| 👤 Person | Repair Cost (₹) | Discount% | Discounted Value (₹) | GST 18% (₹) | Final Amount (₹) |

| A | 5,500 | 30% | 3,850 | 693 | 4,543 |

| B | 6,250 | 40% | 3,750 | 675 | 4,425 |

| C | 4,800 | 30% | 3,360 | 605 | 3,965 |

| D | 7,200 | 20% | 5,760 | 1,037 | 6,797 |

| E | 3,500 | 40% | 2,100 | 378 | 2,478 |

📊 Total money received including GST = ₹4,543 + ₹4,425 + ₹3,965 + ₹6,797 + ₹2,478 = ✅ ₹22,208 ✅

5. 🛒 Intra-State Goods Transaction – GST = 5%

| Quantity | MRP/item (₹) | Discount% | Total MRP (₹) | Discounted Value (₹) |

| 36 | 450 | 10% | 16,200 | 14,580 |

| 48 | 720 | 20% | 34,560 | 27,648 |

| 60 | 300 | 30% | 18,000 | 12,600 |

| 24 | 360 | 20% | 8,640 | 6,912 |

🧾 Total Discounted Value = ₹14,580 + ₹27,648 + ₹12,600 + ₹6,912 = ₹61,740

🧮 GST @5% = ₹3,087

✅ Amount of bill = ₹61,740 + ₹3,087 = ✅ ₹64,827 ✅

Question 5: 🛒

| Item No. | Quantity | MRP per item (₹) | Discount % | Total MRP (₹) | Discount Amount (₹) | Discounted Value (₹) | GST (5%) (₹) | Final Amount (₹) |

| 1 | 36 | ₹450 | 10% | ₹16,200 | ₹1,620 | ₹14,580 | ₹729 | ₹15,309 |

| 2 | 48 | ₹720 | 20% | ₹34,560 | ₹6,912 | ₹27,648 | ₹1,382.4 | ₹29,030.4 |

| 3 | 60 | ₹300 | 30% | ₹18,000 | ₹5,400 | ₹12,600 | ₹630 | ₹13,230 |

| 4 | 24 | ₹360 | 20% | ₹8,640 | ₹1,728 | ₹6,912 | ₹345.6 | ₹7,257.6 |

- Total Discounted Value = ₹14,580 + ₹27,648 + ₹12,600 + ₹6,912 = ₹61,740

- Total GST (5%) = ₹61,740 × 5% = ₹3,087

- Total Bill Amount = ₹61,740 + ₹3,087 = ₹64,827

✅ Amount of bill = ₹64,827

Question 6: 🚛

| Item No. | Quantity | MRP per item (₹) | Discount % | Total MRP (₹) | Discount Amount (₹) | Discounted Value (₹) | IGST (18%) (₹) | Final Amount (₹) |

| 1 | 35 | ₹420 | 10% | ₹14,700 | ₹1,470 | ₹13,230 | ₹2,383.40 | ₹15,613.40 |

| 2 | 47 | ₹600 | 10% | ₹28,200 | ₹2,820 | ₹25,380 | ₹4,572.40 | ₹29,952.40 |

| 3 | 20 | ₹350 | 20% | ₹7,000 | ₹1,400 | ₹5,600 | ₹1,008 | ₹6,608 |

- Total Discounted Value = ₹13,230 + ₹25,380 + ₹5,600 = ₹44,210

- Total IGST (18%) = ₹44,210 × 18% = ₹7,957.80

- Total Bill Amount = ₹44,210 + ₹7,957.80 = ₹52,167.80

✅ Amount of bill = ₹52,167.80

Question 7: 🛍️ Intra-state Transaction of Goods/Services

| Item No. | MRP (₹) | Discount % | Discounted Value (₹) | CGST % | CGST Amount (₹) | SGST % | SGST Amount (₹) | Total Amount (₹) |

| 1 | ₹12,000 | 30% | ₹8,400 | 6% | ₹504 | 6% | ₹504 | ₹9,408 |

| 2 | ₹15,000 | 20% | ₹12,000 | 9% | ₹1,080 | 9% | ₹1,080 | ₹14,160 |

| 3 | ₹9,500 | 30% | ₹6,650 | 14% | ₹931 | 14% | ₹931 | ₹8,512 |

| 4 | ₹18,000 | 40% | ₹10,800 | 2.5% | ₹270 | 2.5% | ₹270 | ₹11,340 |

- Total Bill Amount = ₹9,408 + ₹14,160 + ₹8,512 + ₹11,340 = ₹43,420

✅ Amount of bill = ₹43,420

Question 8: 🔄 Inter-state Transaction of Goods/Services

| Item No. | MRP (₹) | Discount % | Discounted Value (₹) | IGST % | IGST Amount (₹) | Total Amount (₹) |

| 1 | ₹12,000 | 30% | ₹8,400 | 12% | ₹1,008 | ₹9,408 |

| 2 | ₹15,000 | 20% | ₹12,000 | 18% | ₹2,160 | ₹14,160 |

| 3 | ₹9,500 | 30% | ₹6,650 | 28% | ₹1,862 | ₹8,512 |

| 4 | ₹18,000 | 40% | ₹10,800 | 5% | ₹540 | ₹11,340 |

- Total Bill Amount = ₹9,408 + ₹14,160 + ₹8,512 + ₹11,340 = ₹43,420

✅ Amount of bill = ₹43,420

9. 🛒

| Items | Quantity | Rate per Items (₹) | Total Cost (₹) | Discount | Discount Amount (₹) | Discounted Value (₹) | IGST (18%) (₹) | Total Amount (₹) |

| Item 1 | 10 | 180 | 1,800 | 0% | 0 | 1,800 | 324 | 2,124 |

| Item 2 | 20 | 260 | 5,200 | 20% | 1,040 | 4,160 | 748.80 | 4,908.80 |

| Item 3 | 30 | 310 | 9,300 | 0% | 0 | 9,300 | 1,674 | 10,974 |

| Item 4 | 20 | 175 | 3,500 | 30% | 1,050 | 2,450 | 441 | 2,891 |

Total Amount = ₹2,124 + ₹4,908.80 + ₹10,974 + ₹2,891 = ₹20,897.80

✅ Total amount of bill = ₹20,897.80

10.

| Service | Number of Services | Cost per Service (₹) | Total Cost (₹) | IGST (%) | IGST Amount (₹) | Total Amount (₹) |

| Service 1 | 8 | 680 | 5,440 | 5% | 272 | 5,712 |

| Service 2 | 12 | 320 | 3,840 | 12% | 460.80 | 4,300.80 |

| Service 3 | 10 | 260 | 2,600 | 18% | 468 | 3,068 |

| Service 4 | 16 | 420 | 6,720 | 12% | 806.40 | 7,526.40 |

Total Amount = ₹5,712 + ₹4,300.80 + ₹3,068 + ₹7,526.40 = ₹20,607.20

✅ Amount of bill = ₹20,607.20

EXERCISE 1(A)

9. 🛒

Formula: Total Cost = Quantity × Rate per item

- Formula: Discount Amount = Total Cost × (Discount% / 100)

- Formula: Discounted Value = Total Cost – Discount Amount

- Formula: IGST Amount = Discounted Value × (2 × SGST%) (since it’s an inter-state transaction, IGST = 2 × SGST%)

- Formula: Total Amount = Discounted Value + IGST Amount

Item 1:

- Quantity = 10, Rate = ₹180

- Total Cost = 10 × ₹180 = ₹1,800

- Discount = 0%, so Discount Amount = ₹1,800 × 0% = ₹0

- IGST (18%) = ₹1,800 × 18% = ₹324

- Total Amount = ₹1,800 + ₹324 = ₹2,124

Item 2:

- Quantity = 20, Rate = ₹260

- Total Cost = 20 × ₹260 = ₹5,200

- Discount = 20%, so Discount Amount = ₹5,200 × 20% = ₹1,040

- Discounted Value = ₹5,200 – ₹1,040 = ₹4,160

- IGST (18%) = ₹4,160 × 18% = ₹748.80

- Total Amount = ₹4,160 + ₹748.80 = ₹4,908.80

Item 3:

- Quantity = 30, Rate = ₹310

- Total Cost = 30 × ₹310 = ₹9,300

- Discount = 0%, so Discount Amount = ₹9,300 × 0% = ₹0

- IGST (18%) = ₹9,300 × 18% = ₹1,674

- Total Amount = ₹9,300 + ₹1,674 = ₹10,974

Item 4:

- Quantity = 20, Rate = ₹175

- Total Cost = 20 × ₹175 = ₹3,500

- Discount = 30%, so Discount Amount = ₹3,500 × 30% = ₹1,050

- Discounted Value = ₹3,500 – ₹1,050 = ₹2,450

- IGST (18%) = ₹2,450 × 18% = ₹441

- Total Amount = ₹2,450 + ₹441 = ₹2,891

Total Amount = ₹2,124 + ₹4,908.80 + ₹10,974 + ₹2,891 = ₹20,897.80

✅ Total amount of bill = ₹20,897.80

-

📘 Becoming an Astronaut in India (ISRO) – A Complete Guide After Class 12

📘 Becoming an Astronaut in India (ISRO) – A Complete Guide After Class 12 ✍️…

-

Top 20 Shubh Tracks You MUST Watch on @SHUBHWORLDWIDE 🎧

Top 20 Shubh Tracks You MUST Watch on @SHUBHWORLDWIDE 🎧 📝 Top 20 Shubh Tracks…

-

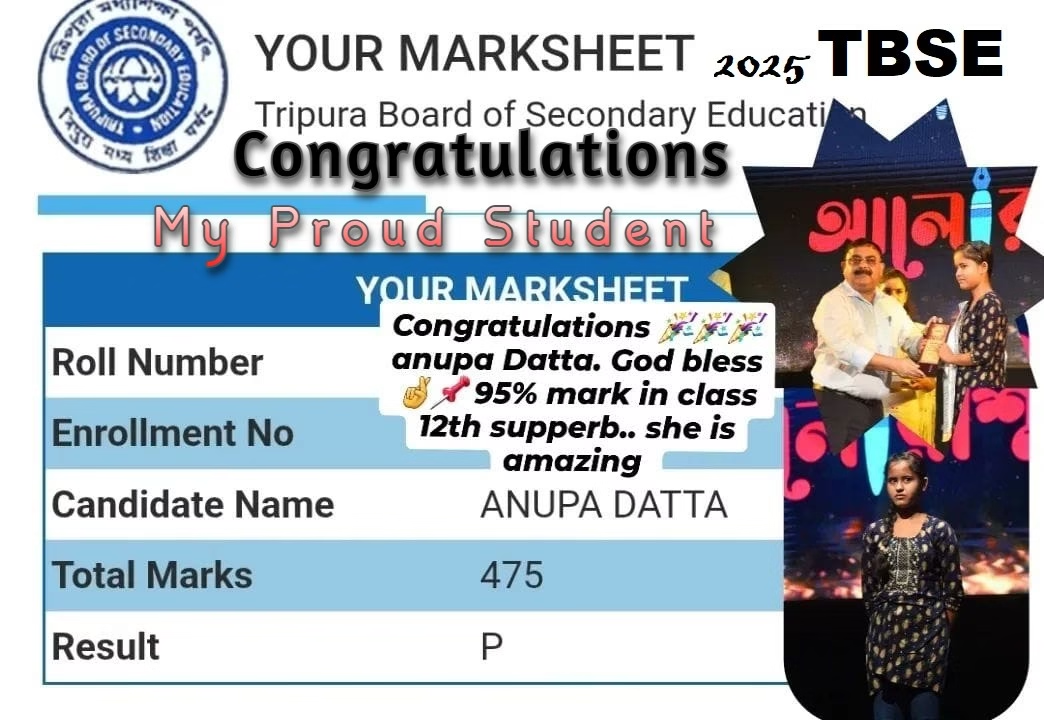

🌟🎉 Anupa Datta Shines Again with 475 Marks in TBSE Class 12 Science 2025 – A True Inspiration! Tbse Board Result 2025 🎉🌟

📅 Published on: April 30, 2025📍 Agartala, Tripura In a world where challenges often dim…

-

🚀 bAstronautWay – Your Ultimate Learning Destination! 🎓✨

TBSE CBSE Undergraduate and Postgraduate Entrance Exams 📍 Our Locations: 9863002294 / 7005561197 📚 Courses…

-

🏆 Pratik Waikar: The Unstoppable Kho Kho World Cup Captain 2025

Discover the inspiring journey of Pratik Waikar, India’s Kho Kho sensation, as he rises to…

-

🏆Sandeep Arya: The Iron Will of Surya Namaskar

In the world of yoga endurance, one name stands with extraordinary strength and discipline —…

-

Rosan Kujur: Odisha’s Midfield Dynamo Rising for India 🇮🇳🏑

In the modern era of Indian hockey, where speed, tactical intelligence, and composure define greatness,…

10. 🧾

- Formula: Total Cost = Number of services × Cost per service

- Formula: IGST Amount = Total Cost × GST% (since inter-state, IGST applies)

- Formula: Total Amount = Total Cost + IGST Amount

Service 1:

- Number of services = 8, Cost per service = ₹680

- Total Cost = 8 × ₹680 = ₹5,440

- IGST (5%) = ₹5,440 × 5% = ₹272

- Total Amount = ₹5,440 + ₹272 = ₹5,712

Service 2:

- Number of services = 12, Cost per service = ₹320

- Total Cost = 12 × ₹320 = ₹3,840

- IGST (12%) = ₹3,840 × 12% = ₹460.80

- Total Amount = ₹3,840 + ₹460.80 = ₹4,300.80

Service 3:

- Number of services = 10, Cost per service = ₹260

- Total Cost = 10 × ₹260 = ₹2,600

- IGST (18%) = ₹2,600 × 18% = ₹468

- Total Amount = ₹2,600 + ₹468 = ₹3,068

Service 4:

- Number of services = 16, Cost per service = ₹420

- Total Cost = 16 × ₹420 = ₹6,720

- IGST (12%) = ₹6,720 × 12% = ₹806.40

- Total Amount = ₹6,720 + ₹806.40 = ₹7,526.40

Total Amount = ₹5,712 + ₹4,300.80 + ₹3,068 + ₹7,526.40 = ₹20,607.20

✅ Amount of bill = ₹20,607.20

11. 📱

- Formula: GST Amount = Cost × GST%

- Formula: Total Amount = Cost + GST Amount

Cost = ₹750

GST (18%) = ₹750 × 18% = ₹135

Total Amount = ₹750 + ₹135 = ₹885

✅ Amount of bill = ₹885

12. 🏥

- Formula: Total GST = 2 × SGST (since GST = CGST + SGST)

- Formula: Premium = (Total Amount – Total GST) / (1 + GST%)

SGST = ₹900

Total GST = 2 × ₹900 = ₹1,800

GST% = 18%

Since SGST is 9% of the premium,

Premium × 9% = ₹900

Premium = ₹900 / 0.09 = ₹10,000

Total Amount = 10,000 + 1,800 = ₹11,800

✅ Total annual premium = ₹11,800

13. 🏨

- Formula: Total Cost will be = (Room Cost × Days) + (Extra Bed Cost × Days)

- Formula: GST Amount = Total Cost × GST%

Room Cost will be = 2 × ₹5,000 = ₹10,000

Extra Bed Cost will be = 2 × ₹1,000 = ₹2,000

Total Cost = ₹10,000 + ₹2,000 = ₹12,000

GST (28%) = ₹12,000 × 28% = ₹3,360

✅ GST charged = ₹3,360

Written By

Full Stack Developer and 5-Time World Record Holder, Grandmaster Bikram Sutradhar

bAstronautWay

SirBikramSutradhar on YouTube

More Story click the link

Selina Mathematics Chapter 1: GST Exercise 1(A) Class 10 Selina Mathematics Chapter 1: GST

ICSE Class 10 Selina Mathematics

ICSE CLASS 10 ICSE CLASS 10 BIOLOGY BASTRONAUTWAY SirBikramSutradhar Bikram Sutradhar GrandMaster Bikram Sutradhar selina biology solutions ICSE Biology Selina Solution

📚 Class 9 Science – Complete Table of Contents (विषय-सूची)

CBSE | NCERT Curriculum | Bilingual (English + Hindi)

By Grandmaster Bikram Sutradhar | SirBikramSutradhar | BASTRONAUTWAY

🔬 PHYSICS (भौतिक विज्ञान)

| 🔢 | Chapter Title (English) | अध्याय का नाम (हिंदी) | Page No. |

| 1️⃣ | Motion | गति | |

| 2️⃣ | Force and Laws of Motion | बल तथा गति के नियम | |

| 3️⃣ | Gravitation | गुरुत्वाकर्षण | |

| 4️⃣ | Work and Energy | कार्य तथा ऊर्जा | |

| 5️⃣ | Sound | ध्वनि |

🧪 CHEMISTRY (रसायन विज्ञान)

| 🔢 | Chapter Title (English) | अध्याय का नाम (हिंदी) | Page No. |

| 1️⃣ | Matter in Our Surroundings | हमारे आस-पास के पदार्थ | |

| 2️⃣ | Is Matter Around Us Pure? | क्या हमारे आस-पास के पदार्थ शुद्ध हैं? | |

| 3️⃣ | Atoms and Molecules | परमाणु एवं अणु | |

| 4️⃣ | Structure of the Atom | परमाणु की संरचना |

🧬 BIOLOGY (जीव विज्ञान)

| 🔢 | Chapter Title (English) | अध्याय का नाम (हिंदी) | Page No. |

| 1️⃣ | The Fundamental Unit of Life | जीवन की मौलिक इकाई | |

| 2️⃣ | Tissues | ऊतक | |

| 3️⃣ | Improvement in Food Resources | धनों में सुधार |

📘 ADDITIONAL SECTIONS (अतिरिक्त अनुभाग)

| 📖 Section | Title (English + Hindi) |

| 🔹 | Glossary / पारिभाषिक शब्दावली |

| 🔹 | Answer Keys / उत्तरमाला |

| 🔹 | Summary / सारांश |

| 🔹 | Important Diagrams / महत्वपूर्ण चित्र |

| 🔹 | NCERT Exercises / एनसीईआरटी अभ्यास |

| 🔹 | Sample Papers & MCQs / मॉडल पेपर व वस्तुनिष्ठ प्रश्न |

✅ All content follows the official NCERT Class 9 Science textbook structure. Each chapter will include explanations, bilingual notes, definitions, diagrams, MCQs, FAQs, and practice exercises under the BASTRONAUTWAY learning system.

class 10 Maths ncert solution.

CBSE Class 10 Mathematics (2025) NCERT Syllabus:

CBSE Class 10 Mathematics NCERT Syllabus (2025) – Chapter-Wise List

CBSE Class 10 Mathematics NCERT Syllabus (2025) – Chapter-Wise List

chapter 4. Quadratic Equations

chapter 5. Arithmetic Progressions

chapter 6. Triangles

chapter 7. Coordinate Geometry

chapter 8. Introduction to Trigonometry

chapter 9. Some Applications of Trigonometry

chapter 11. Areas Related to Circles

chapter 12. Surface Areas and Volumes

CBSE Class 10 Science (2025) NCERT Syllabus:

CBSE Class 10 Science NCERT Syllabus (2025) – Chapter-Wise List

CBSE Class 10 Science NCERT Syllabus (2025) – Chapter-Wise List

Chapter 1 Chemical Reactions and Equations

Chapter 2 Acids, Bases and Salts

Chapter 3 Metals and Non-metals

Chapter 4 Carbon and its Compounds

Chapter 5 Life Processes

Chapter 6 Control and Coordination

Chapter 7 How do Organisms Reproduce?

Chapter 8 Heredity

Chapter 9 Light – Reflection and Refraction

Chapter 10 The Human Eye and the Colourful World

Chapter 11 Electricity

Chapter 12 Magnetic Effects of Electric Current

Chapter 13 Our Environment

📖 Chapter 12 – Organic Chemistry (Selina Textbook)

Table of Contents:

- 12A. Organic Compounds

- 12B. Hydrocarbons: Alkanes

- 12C. Hydrocarbons: Alkenes

- 12D. Hydrocarbons: Alkynes

- 12E. Alcohols

- 12F. Carboxylic Acids

- Exercise 12 MISCELLANEOUS

- Glossary

- Model Question Paper –

📌 Exercise 12 MISCELLANEOUS – Focus Areas:

- 🧬 Consolidated practice from the entire Organic Chemistry chapter

- 🧪 Application-based questions covering alkanes, alkenes, alkynes, alcohols, and carboxylic acids

- 🧾 Writing structural formulas and chemical equations

- 💡 Distinguishing reactions, isomer identification, and conversions

- 📘 Full-syllabus revision to boost conceptual clarity and board exam readiness

Each question in this section is designed to:

- ✅ Strengthen cross-topic understanding

- 📝 Prepare students for application-based and reasoning-based questions

- 🧠 Improve problem-solving speed and exam performance

class 5

📚 Class 9 Science – Complete Table of Contents (विषय-सूची)